What Do We Really Mean?

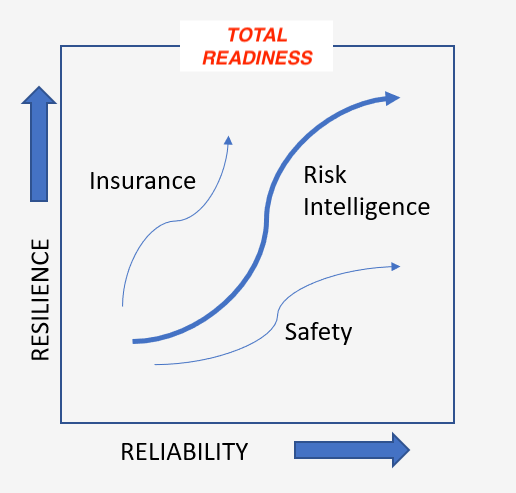

The concept of risk intelligence can be understood as practices that go before, along with, and beyond risk management. Whenever there is a concern for safety and security, there is also the necessity of risk intelligence. Risk intelligence is an antidote for excessive fear and doubt. Organizational strategists apply risk intelligence when discussing integrative systems. It belongs in any conversation about improving readiness, reliability, resilience, agility, governance, compliance, strategy, value creation, well-being and leadership.

Risk intelligence is an organization's shared knowledge about the effects of uncertainty, combined with the essential language, skills, and tools it chooses to help achieve better outcomes.

Why It Matters?

Risk intelligence matters because it changes the odds of success in your favor. Inaction and obstacles are overcome when a certain level of optimism exists in the mindsets and culture of a school system. At the same time, there remain vulnerabilities, performance shortcomings, missed opportunities, and circumstances that give rise to crises. Too often we talk about risk in a variety of ways, without fully examining what they mean or knowing fully how actions in one area affect results in another area.

Stakeholders benefit when risk intelligence is increasing among all the people in an organization.

Why Now?

As the term gains wider use among businesses, nonprofits and universities, risk intelligence is an important concept to understand and put to greater use. Success in the new normal requires being smarter about uncertainty and using the best tools available to achieve desired results.

Strategic planning with risk intelligence usually leads to success. Reaching the desired goals of transformation and improvement is highly dependent on deeper and broader risk intelligence across the enterprise.

Leo Tilman, financial executive, author, and Columbia University professor makes the case that risk intelligence is essential to survival, success, and relevance of organizations in the post-crisis world. In his 2019 book Agility: How to Navigate the Unknown and Seize Opportunity in a World of Disruption, co-authored with General Charles H. Jacoby Jr., risk intelligence is described as a cornerstone of organizational agility.

More Views on Risk Intelligence

In writing about how to create a risk intelligent enterprise, Deloitte consulting practice leaders Rick Funston and Stephen Wagner explain risk intelligence as a dynamic approach to protect and create value amid uncertainty. For them, it is an enterprise wide process for integrating people, processes (systems), and tools to increase information available for improved decision-making.

Dylan Evans, UK philosopher and psychologist, views risk intelligence as "a special kind of intelligence for thinking about risk and uncertainty." It’s his belief that the core element of risk intelligence is the ability to estimate probabilities accurately. Youtube.

In contrast, David Apgar, US business writer, defines risk intelligence as the capacity to learn about risk from experience.

According to Leo Tilman, risk intelligence has three key elements: "(1) The organizational ability to think holistically about risk and uncertainty, (2) speak a common risk language, and (3) effectively use forward-looking risk concepts and tools in making better decisions, alleviating threats, capitalizing on opportunities, and creating lasting value."

Click here for a Youtube Audio Summary

Putting It All Together

Courage alone is not enough. Training, cameras, and seat belts provide a certain degree of security. Handrails, sensors, and PPE are just a small part of a safety program. Without sufficient risk intelligence, unfortunately there will be more gaps, more disruptions, more oversights, and ultimately more missed goals, injuries, and added costs.

Risk intelligent leaders understand that conventional safety and risk management only go so far. They also recognize the opportunities interwoven in every challenge. A culture that recognizes well thought out ownership of risk is essential for dealing with the complexity in today’s fast paced operating environment.

Greater risk intelligence will help everyone accurately define reality, more fully appreciate limitations, and continuously improve the culture and skills that keep organization's functioning at peak performance over the long run.